Investing sounds intimidating, doesn’t it? Between stock market jargon, crypto hype, and endless TikToks pushing “get rich quick” schemes, it’s no wonder so many people feel overwhelmed before they even begin. But here’s the truth: you don’t need a finance degree, a pile of cash, or nerves of steel to become an investor.

You can start building real wealth from your couch—with just a few simple steps, a solid plan, and zero panic attacks. Let’s break down how to start investing in a way that feels doable, not dreadful.

You Don’t Need a Lot of Money to Begin

One of the biggest myths is that you need thousands of dollars to invest. Not true. These days, apps like Robinhood, Fidelity, and Wealthfront let you start with as little as $5. Some even offer fractional shares, meaning you can buy a piece of a stock without shelling out hundreds for a single share. The most important thing isn’t how much you start with—it’s that you start. Building the habit is more powerful than waiting for a mythical “right time.”

Keep It Simple With Index Funds

If picking individual stocks sounds stressful, that’s because it kind of is. For beginner investors, index funds are your low-stress best friend. They spread your money across a wide range of companies, which helps reduce risk. Think of it as the sampler platter of investing—you get a little bit of everything, and you don’t have to worry about which company is going to tank next week. Plus, they usually come with lower fees and require zero maintenance from you.

Automate So You Can Set It and Forget It

The easiest way to invest without losing sleep? Automate it. Set up automatic transfers from your checking account into your investment account every month—or even every paycheck. That way, investing becomes part of your routine, like paying bills or ordering your favorite takeout. Over time, those consistent contributions add up big. And the best part? You barely have to think about it.

Don’t Try to Time the Market

Everyone dreams of buying low and selling high, but even professional investors struggle to time the market perfectly. The good news is, you don’t have to. The longer you leave your money invested, the more likely you are to ride out the market’s ups and downs and come out ahead. Focus on time in the market, not timing the market. It’s less stressful, more realistic, and a lot more effective in the long run.

Learn a Little as You Go

You don’t need to become a finance expert overnight, but learning the basics can help you feel more confident. Read a few blogs, listen to a podcast like The Money Guy Show or Girls That Invest, or follow a trustworthy financial creator. The more familiar you get with terms like “compound interest” or “diversification,” the less intimidating everything feels. Think of it like learning to cook—start with a simple recipe, and before you know it, you’re making gourmet meals (or at least not burning toast). Starting to invest doesn’t have to mean gambling your savings or giving yourself a headache every time the market dips. With a little patience, some smart choices, and a set-it-and-forget-it mindset, you can turn your couch time into cash flow. The best part? You’ll be building a future where your money works for you—even while you sleep. So open that app, transfer that first $50, and let the quiet power of investing start doing its thing.…

One of the most obvious reasons to hire an accountant is because they can help you save money on your taxes. By understanding the tax code and taking advantage of deductions and credits, an accountant can help lower your tax bill. This can free up cash flow for other business expenses or investments.

One of the most obvious reasons to hire an accountant is because they can help you save money on your taxes. By understanding the tax code and taking advantage of deductions and credits, an accountant can help lower your tax bill. This can free up cash flow for other business expenses or investments. An accountant can create a system for tracking income and expenses so you always know where your business stands financially. This level of organization can help streamline your business operations and make it easier to run your business effectively.

An accountant can create a system for tracking income and expenses so you always know where your business stands financially. This level of organization can help streamline your business operations and make it easier to run your business effectively. An accountant can help you create a roadmap for the future of your business. They can help you develop long-term financial goals and create a plan to achieve them. This level of planning can give you peace of mind knowing that your business is on track to reach its full potential.

An accountant can help you create a roadmap for the future of your business. They can help you develop long-term financial goals and create a plan to achieve them. This level of planning can give you peace of mind knowing that your business is on track to reach its full potential.

Before going for any chartered financial planner, know you have to do some self-examination first. Are you a big spender? Are you looking at how to channel money into a retirement plan?

Before going for any chartered financial planner, know you have to do some self-examination first. Are you a big spender? Are you looking at how to channel money into a retirement plan? To be a chartered financial planner there are rigorous training steps and examinations. For instance, an investment adviser ought to be registered with the Securities and Exchange Commission.

To be a chartered financial planner there are rigorous training steps and examinations. For instance, an investment adviser ought to be registered with the Securities and Exchange Commission. Some financial planners will give you a retainer. It works if you are running a business and you need a chartered financial planner on board. Others might charge an hourly fee or work out a commission.

Some financial planners will give you a retainer. It works if you are running a business and you need a chartered financial planner on board. Others might charge an hourly fee or work out a commission.

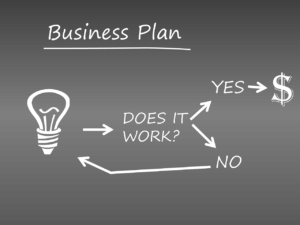

A business plan is the foundation of any successful business. Unfortunately, many business owners do not take time to create a structured blueprint of the operations, especially if they feel like they do not need outside financing. While you might not be looking for investors during the launch, you do not have to draft one when the opportunity presents itself hurriedly.

A business plan is the foundation of any successful business. Unfortunately, many business owners do not take time to create a structured blueprint of the operations, especially if they feel like they do not need outside financing. While you might not be looking for investors during the launch, you do not have to draft one when the opportunity presents itself hurriedly. Anyone working on a full-time job understands that the taxman has to get their share before funds land into the account. Individual tax matters are usually simple to understand. However, things become quite complicated when dealing with business finances. It is usually easy to be caught up in the business’s daily operations, probably neglecting your tax responsibilities. The best way to handle your tax responsibilities is to work with this accounting firm serving Buckinghamshire or any other chartered accountants conversant with tax laws applicable to your jurisdiction.

Anyone working on a full-time job understands that the taxman has to get their share before funds land into the account. Individual tax matters are usually simple to understand. However, things become quite complicated when dealing with business finances. It is usually easy to be caught up in the business’s daily operations, probably neglecting your tax responsibilities. The best way to handle your tax responsibilities is to work with this accounting firm serving Buckinghamshire or any other chartered accountants conversant with tax laws applicable to your jurisdiction.

Auto Loans

Auto Loans

When you need a professional insolvency practitioner, make sure that you contact a few of these experts to ask for an estimate of costs for the course of services that you are seeking for your business. In doing this, you will have a good idea of the costs and fees that you will incur in this process. Before you make any remarks, remember that the cheapest option is not the best always.

When you need a professional insolvency practitioner, make sure that you contact a few of these experts to ask for an estimate of costs for the course of services that you are seeking for your business. In doing this, you will have a good idea of the costs and fees that you will incur in this process. Before you make any remarks, remember that the cheapest option is not the best always.

Avoid trying to be a know-it-all person. You need qualified people for water damage restoration to check the damage and identify the affected areas, the implication of the loss, and the way forward for fixing the problem. You should also direct your questions to the technician inspecting so that you have a sufficient debrief of the situation. You need to be involving yourself with the assessment strictly to avoid assumptions and generalization that might hide other lingering disasters.

Avoid trying to be a know-it-all person. You need qualified people for water damage restoration to check the damage and identify the affected areas, the implication of the loss, and the way forward for fixing the problem. You should also direct your questions to the technician inspecting so that you have a sufficient debrief of the situation. You need to be involving yourself with the assessment strictly to avoid assumptions and generalization that might hide other lingering disasters.

will guarantee you a

will guarantee you a

If you live nearby to your workplace, why not walk to your workplace? Instead of spending your money on gas or other transportation fees,

If you live nearby to your workplace, why not walk to your workplace? Instead of spending your money on gas or other transportation fees,

Most people like to spend their hard-earned money on a five-star hotel on their vacation, which is a waste of money. Think of your accommodation as a place where you put your things and for you to shower and rest, nothing more. With that being said, we suggest that you paid for a hotel that’s not too expensive but still safe and trusted enough. When you think about it, you’re going to spend most of your time outside, so an expensive hotel will not be worth it. We suggest trying a capsule hotel or Airbnb for cheaper accommodation.

Most people like to spend their hard-earned money on a five-star hotel on their vacation, which is a waste of money. Think of your accommodation as a place where you put your things and for you to shower and rest, nothing more. With that being said, we suggest that you paid for a hotel that’s not too expensive but still safe and trusted enough. When you think about it, you’re going to spend most of your time outside, so an expensive hotel will not be worth it. We suggest trying a capsule hotel or Airbnb for cheaper accommodation. Now here’s where it gets tricky. Some people are biased on eating a specific type of food, and it can get quite expensive when you’re traveling to another country. For example, eating western food in a south-east Asian country will get pricey, and it might not taste just like how you want it. So, a tip from us to save some money on food is to buy groceries in the market and cook it for dinner back at the apartment or hotel. If you feel brave to try new things, why not ask the locals on where they can eat tasty and cheap as this will save your money for other things, such as souvenirs or entertainments.…

Now here’s where it gets tricky. Some people are biased on eating a specific type of food, and it can get quite expensive when you’re traveling to another country. For example, eating western food in a south-east Asian country will get pricey, and it might not taste just like how you want it. So, a tip from us to save some money on food is to buy groceries in the market and cook it for dinner back at the apartment or hotel. If you feel brave to try new things, why not ask the locals on where they can eat tasty and cheap as this will save your money for other things, such as souvenirs or entertainments.…